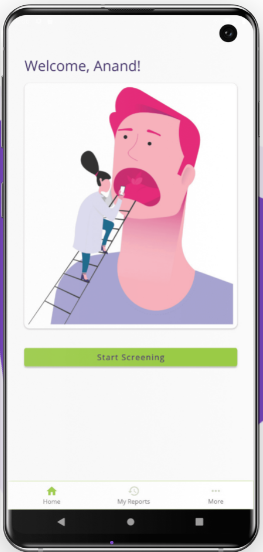

5Paisa.com, a fin-tech firm, on Thursday announced the launch of its peer-to-peer (P2P) lending platform — 5Paisa Loans. The lending platform will function as a subsidiary of its listed parent, 5Paisa.com, and will have a separate application as well as website.

In its statement, the company said 5Paisa Loans would enable individuals to lend between Rs 500 to Rs 50 lakh to multiple borrowers and the lenders could earn an interest rate of up to 36% per annum. 5Paisa loans, which acquired an NBFC license from the Reserve Bank of India (RBI) in December 2019, intends to solve short-term cash requirements of borrowers from all walks of life while giving an opportunity to lenders to earn on their idle money, the company stated.

5Paisa loans would use artificial intelligence-based underwriting to assess the creditworthiness of a borrower. The lending platform will screen every borrower using 100 variable data points such as age, location, earnings, previous loan history, social profile and expenditure, among others. It would then present the information through an unified score for lenders to make their choices. The platform would earn commission for every loan that has been sanctioned from the lender as well as borrower.

Prakarsh Gagdani, CEO of 5Paisa.com, said, “Given that P2P lending is a very niche industry, 5Paisa would be the first listed company to enter the market and our plan is to become a leader in the next 12 months.”

The fin-tech firm stated that it is serving around 5.5 lakh customers and is India’s only diversified platform for fin-tech products. Apart from P2P lending, 5Paisa.com facilitates investments in equity, debt and gold on its platform. “We expect our platform (5Paisa loans) will in small-way help to meet consenting borrowers and lenders to fulfil each others’ needs during the unfortunate Covid-19 outbreak,” said Prakarsh Gagdani.